5 Risk Management Tools Used by Professional Traders

Trading is all about taking calculated risks. Without proper risk management, traders can lose all their money at any time following a change in the markets. And stories like that are not uncommon. Over years of trading, I learned how to build a solid risk management plan to protect myself from huge losses. So if you’re not sure how to go about managing risk, this blog post is perfect for you. I am going to show you five trading risk management tools used by professional traders to mitigate risk and trade profitably. I will also show you how you can use Tradervue’s latest feature as part of your risk management plan. So without further ado, let’s get started.

Why You Need Trading Risk Management

Risk management is an essential skill for every professional trader. Successful traders know how to earn profits consistently while keeping losses at an affordable level.

Imagine scoring a huge win one day and losing it all the next day. That would be a huge blow to your account and self-confidence. Without a proper risk management plan, you leave yourself extremely vulnerable to scenarios like:

Keeping a losing position for too long

Losing all your profits due to unexpected market news

Having to earn profits for a long time just to make up for recent losses

A ubiquitous risk management tool is the stop loss. Similarly, common wisdom in trading says you should diversify your portfolio. But to mitigate risk and reduce losses when they occur, you need a risk management plan that relies on several tools.

In addition to protecting your capital and earnings, using these tools helps you trade without the stress and anxiety of knowing that you could lose everything at any time.

So let’s go over five trading risk management tools you should implement to mitigate risk and achieve your trading goals.

1. The Maximum Drawdown

The first step in building your risk management plan is to determine your maximum drawdown.

Your max drawdown (or MDD) is the maximum amount of money you’re willing to lose overall before you stop trading and reassess what you’re doing. When you hit your MDD, it means your strategies are not working, so you need to step back and figure out what you need to change.

Professional traders base their max drawdown around their financial situation and how much they are willing to risk. In other words, you want to set an amount of money that won’t impact your life if you lose it.

All traders already have a max drawdown: it’s their account size. Naturally, if you lose all the money in your account, you can’t trade anymore. Of course, you don’t want to reach that point.

If you are concerned about losing more than your max drawdown, simply make it the maximum amount of money you have in your account. That way, even in the worst case scenario, you won’t lose more than you can afford to.

One of the advanced reports in Tradervue is the Drawdown (also known as Position MAE).

The Drawdown report shows your drawdown plotted in terms of either dollars or R – the risk per trade, which is the second tool risk management you should use.

2. The Risk Per Trade

Once you determine your max drawdown in dollars, next you want to determine your risk per trade, which is a fraction of your max drawdown and also known as R.

In other words, your risk per trade is the number of trades you can afford to lose in a row before you stop trading. This number will vary depending on your experience as a trader.

The reason I recommend using this tool is that even the best trading strategies will have a series of losers sometimes. The most skilled and successful traders in the world still have streaks of losses. It’s only normal — no one can execute their strategy perfectly.

Your risk per trade tells you exactly how many losers you can afford to have before you stop and reevaluate your situation.

How to set your risk per trade

Typically, if you’re a beginner trader, I recommend you set your risk per trade at least 20 trades in a row that you can lose before stopping.

If you’re an intermediate trader with moderate success but still aren’t where you want to be, your risk per trade should be between 15 and 20.

In case you are a highly experienced and successful trader, you can have ten trades you can lose in row before you hit your max drawdown.

Let me give you an example. Say you’re a new trader and your max drawdown is $2,000. You don’t want to risk more than $100 per trade, which is 20 times your max drawdown.

So tracking your R helps you make sure your account can handle a series of losses without you having to stop trading.

Keep in mind that in addition to the random losses that your strategy would naturally generate, you should also factor in the mistakes you’ll make along the way while figuring out what your risk per trade should be.

3. The Daily Loss Limit

The third trading risk management tool I recommend using is the Daily Loss Limit.

Your Daily Loss Limit, or DLL for short, is how much you can afford to lose in a single day.

Every trader has a different DLL, so you need to determine yours based on your trading history.

In my experience, the best way to determine your DLL is to set it at your average good winning day.

There is a psychological reason for that: if you lose more than what you typically make on a good winning day, then the next day you will need to have one of your best days to make back what you lost. This will put a psychological pressure on you that makes it more likely to make mistakes.

So you don’t want to find yourself in a situation where you need to earn significantly more just to make up for a losing day.

How to calculate your Daily Loss Limit

Like I said, your DLL should be your average good winning day. To be clear, I’m not talking about your average winning day or your absolute best winning day either, but specifically your average good winning day.

To calculate your average good winning days, simply look for the midpoint between your average winning day and your best winning day. That should be your Daily Loss Limit.

By making sure that you never set yourself back more than a typical good day, when going into the next day, you won’t feel the kind of pressure that’s going to increase the probability of making mistakes.

4. The Giveback Rule

The giveback rule is a tool that more traders should use because it’s great for managing a common trading problem: giving back profits.

One of the best practices in trading is that you don’t want to let a good day turn into a losing day. If you are having a profitable day, and then it goes bad, you shouldn’t let it go even worse.

This is one of those situations where your trading psychology can work against you. If you’re having a very successful day, and it turns into a losing day, it triggers your fight or flight response, which can cause you to:

Trade too big

Chase after trades

Not hold onto your winners

Make many other common trading mistakes

Many traders will have a very profitable day, but instead of taking their profits, they stay, hoping to earn more. What happens then is that they start losing the money they earned, essentially giving it back to the market.

So the giveback rule is a rule you set for yourself to avoid this pitfall: you stop trading before you give back more than a certain percentage of your profits.

Here is how Mike Bellafiore, co-founder of SMB Capital, defines the giveback rule in his book, The Playbook: An Inside Look at How to Think Like a Professional Trader:

“Traders should develop a giveback rule; that is, if you give back a certain percentage of your profits on the day, then close your positions. No trading should take place for the rest of the day. Yes, swing traders and hedge funders should also adopt a giveback rule.”

– Mike Bellafiore, The Playbook: An Inside Look at How to Think Like a Professional Trader

How to set your giveback rule

A good rule of thumb is that once you reach 3R in profits, meaning 3 times the amount you typically risk on a trade, your getback rule initiates. Essentially, you don’t want to let yourself fall below +1R.

The reason for this is that if you’re having a good day, you want to end it having enough house money the next day to take a trade and if it doesn’t work, you’re still where you started the day before.

The giveback rule will protect you from psychological pitfalls as well as the money in your account.

5. Stop Orders and Bracket Orders

Last but not least in this list are stop orders and bracket orders. Let’s start with stop orders.

Stop orders

A stop order is an order to sell a security when it reaches a certain price to cut your losses.

There is a lot of debate on whether you should use a hard stop on a trade or know where that is and have the discipline to get out when the price reaches that level.

Personally, I highly recommend using a hard stop.

A lot of times, markets can do crazy things, and a trade can go against you so fast that you can freeze. This is a very common situation that happens to new and intermediate traders – even experienced traders sometimes.

It can be shocking when a trade that has been working for a while turns around in the blink of an eye. Maybe some news hits and completely reverses the trade, so it starts going against you hard and fast. Every trader faces this situation at some point.

If you are relying on your own discipline, the speed of the price movement can cause you to freeze. You sit and watch it go down multiple times further than you expect it to, hoping for it to rebound. In that situation, you should use a hard stop to cut your losses before they hurt your account further.

Bracket orders

Using a hard stop order works great, but ideally it’s best to use a bracket order.

A bracket order lets you set a point where you want to take your profits as well as a point where you want to have a stop loss. Hence the name “brackets”.

If it hits your target market, bracket orders will cancel the stop loss you have in place.

Luckily, almost every trading platform has this tool.

Your bracket order allows you to take a moment and step away from the screens. Or if you got distracted by something or if you are looking at another market while you’re having a position open.

Just as markets can quickly move against you, they can also quickly move in your favor sometimes. So you don’t want to be in a situation where the market goes to the area where you’re looking to take profits but maybe you are distracted or busy. Maybe it turns all the way around while you go to the restroom and hits your stop, so you’re not able to get out of that position in time.

Similarly, some people can fall victim to the psychological pitfall where a trade is going in their favor and gets to where they initially planned, so they may think it’s going to get even higher. And then it reverses, so they freeze.

That’s why using bracket orders protects you from the downside while also helping you benefit from the upside.

So I highly recommend you use stop orders and ideally bracket orders to manage your trades. Use stop orders to get out when you’re wrong and bracket orders to get out when you’re right.

Manage Risk with Our New Daily Loss Limit Feature

We have just launched a new feature on Tradervue: the Daily Loss Limit feature.

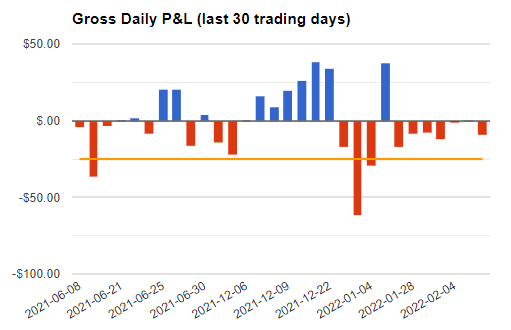

When using Tradervue, you can see your Gross Daily P&L on the Reports section of your account. This new and simple feature lets you visualize your DLL on your Gross Daily P&L.

To display your DLL, simply go to your settings and set your Daily Stop Loss Value. Your Gross Daily P&L will then display a line representing your DLL.

You will know at a glance the days where you exceeded your stop loss. By drilling down into your trades and notes on these losing days, you can find out what you did wrong and learn from it to improve your trading.

Using this feature along with the other reports in Tradervue will help you build a trading risk management plan that keeps your losses acceptable as you develop more and more profitable strategies.

Sign up for a free Tradervue account to track, analyze, and improve your trades.

Author:

Patricia Buczko

Category:

User Stories