What is a Bear Trap and how to avoid?

Bear traps in trading are like optical illusions in the financial markets.

They trick bearish traders into thinking a stock is heading down when it's about to climb.

Understanding these deceptive signals is crucial for making smart investment decisions and avoiding significant losses.

Understanding Bear Traps

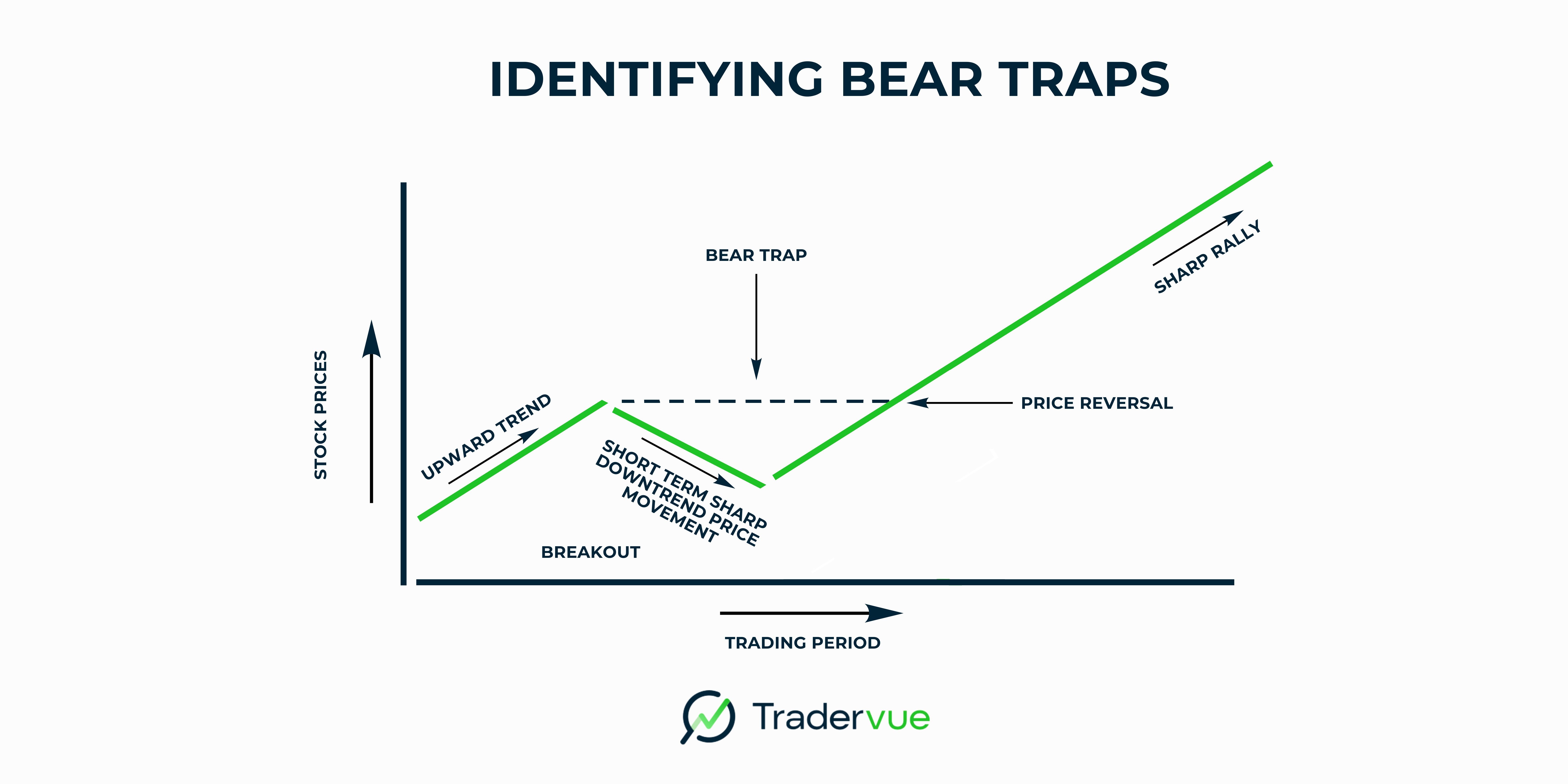

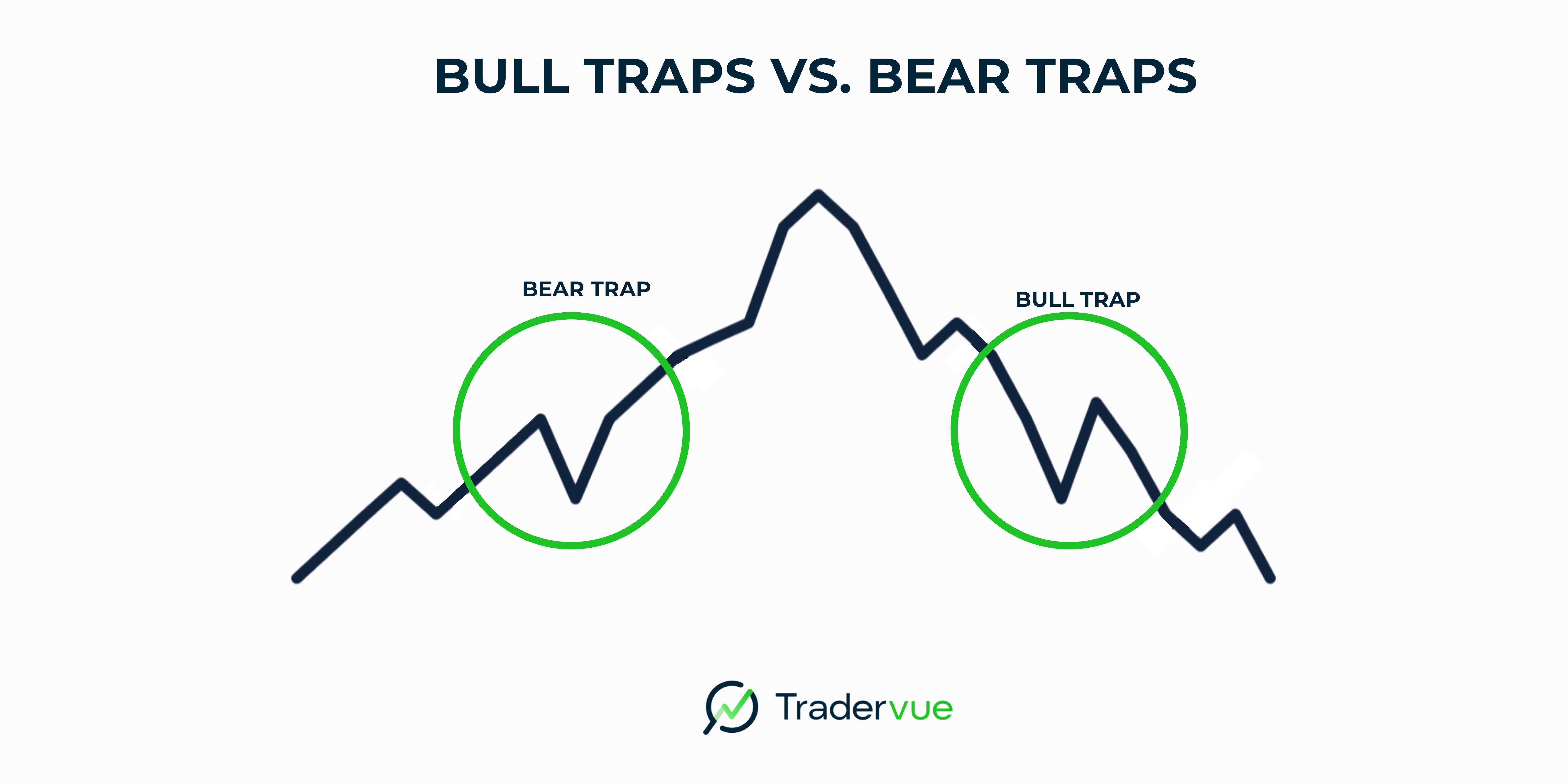

A bear trap forms when price action suggests a downward trend will continue, but instead, prices suddenly reverse upward. False signal can catch short sellers off guard - as prices rise, bears are forced out of their positions - these short sellers need to turn to buyers to exit.

It's important to note that a bear trap is the opposite of a bull trap, where prices falsely indicate an upward trend.

The psychology behind bear traps is a mix of market sentiment and investor behavior. When traders see price drops, greed often drives them to open short positions.

This selling pressure can create a temporary dip below a key support level that lures in more bearish investors.

But when the market experiences a trend reversal, it catches short sellers by surprise, often resulting in a short squeeze.

Bear traps come in different forms:

Technical: Based on chart patterns and technical indicators

Fundamental: Driven by negative news affecting a company's fundamentals

News-driven: Resulting from sudden market reactions to events

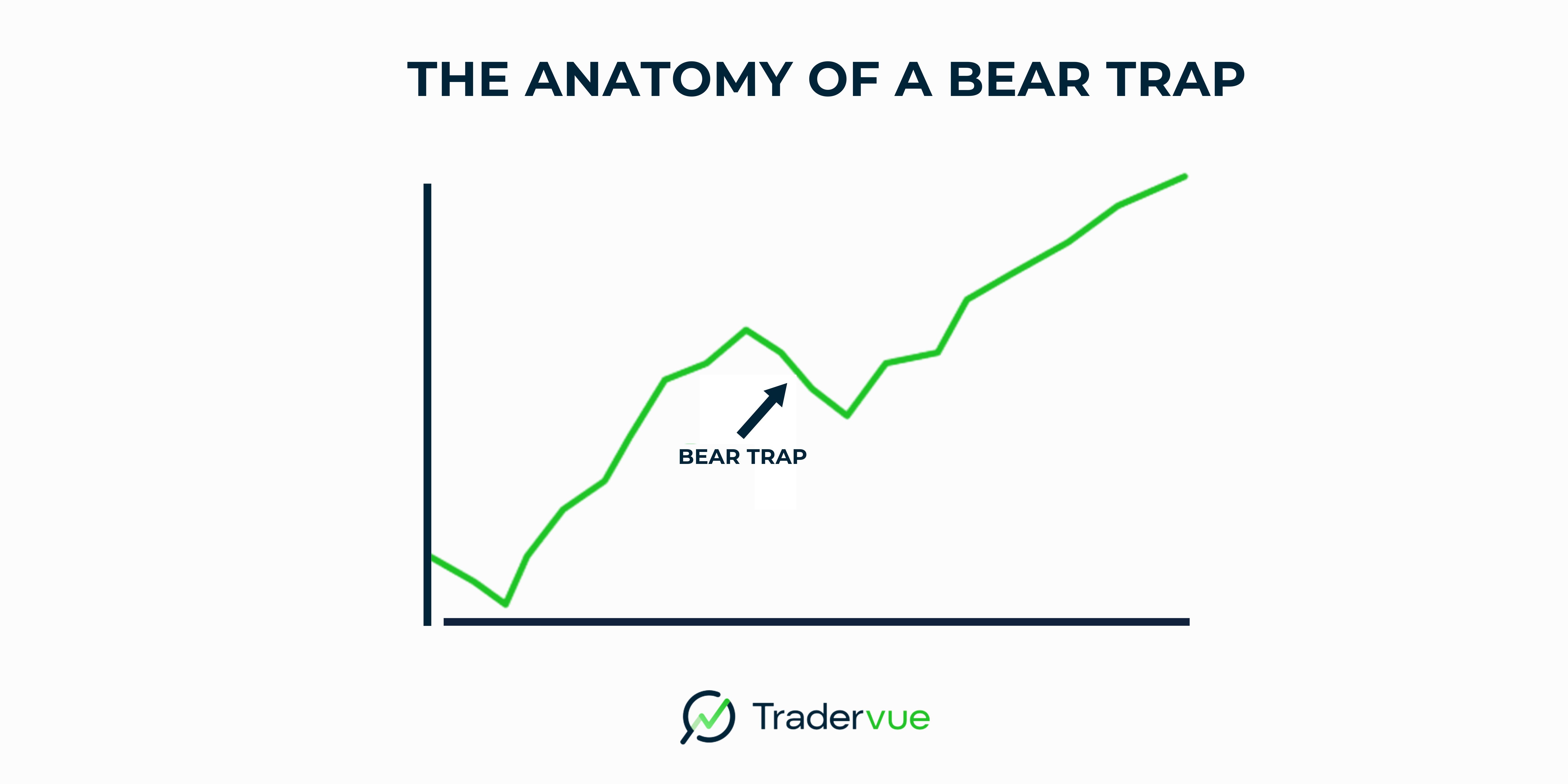

Anatomy of a Bear Trap

Bear traps typically follow a predictable pattern:

Initial upward trend

False breakdown

Trap formation

Reversal and rapid price increase

Recognizing these stages is key to avoiding such pitfalls.

Common candlestick patterns associated with bear traps include false breakdowns, double bottoms, and inverted head and shoulders.

Identifying Bear Traps

Traders use various technical analysis tools to spot potential bear traps:

Technical Analysis

Support and resistance levels

Trend lines and channels

Moving averages

Volume indicators

Momentum indicators (Relative Strength Index, MACD, Stochastic)

Fibonacci levels

Fundamental Analysis

Company financials

Industry trends

Macroeconomic factors

Sentiment Analysis

Social media sentiment

Analyst ratings

Put/call ratios

Bear Traps in Different Markets

Bear traps aren't limited to the stock market.

They can occur in volatile markets like forex, cryptocurrency assets, and commodities. Each financial instrument has its unique characteristics, but the underlying principles of bear traps remain the same.

An example of a bear trap might include a sudden drop in share price followed by a sharp decline in trading volume, only to see a sudden increase in price and volume as large players enter long positions.

This can often lead to a dead cat bounce, fooling traders into thinking the bearish trend has ended.

Strategies to Avoid Bear Traps

To steer clear of bear traps:

Be patient and wait for confirmation of a true reversal

Analyze multiple timeframes

Use risk management techniques like stop-loss orders and proper position sizing

Diversify your portfolio of financial assets

Consider hedging strategies

It's crucial to remember that past performance doesn't guarantee future results. Always conduct thorough research before making investment decisions.

Trading Bear Traps

Savvy traders can profit from bear traps using various trading strategies:

Short-term Trading (Scalping the trap, Breakout trading)

Swing Trading

Long-term Investment Considerations

Options Strategies

Trading bear traps often involves high risk, especially when trading CFDs or in the crypto market.

It's a good idea to develop strong trading skills and consult with an investment advisor before attempting such strategies.

Retail investors should be particularly cautious when dealing with potential bear traps.

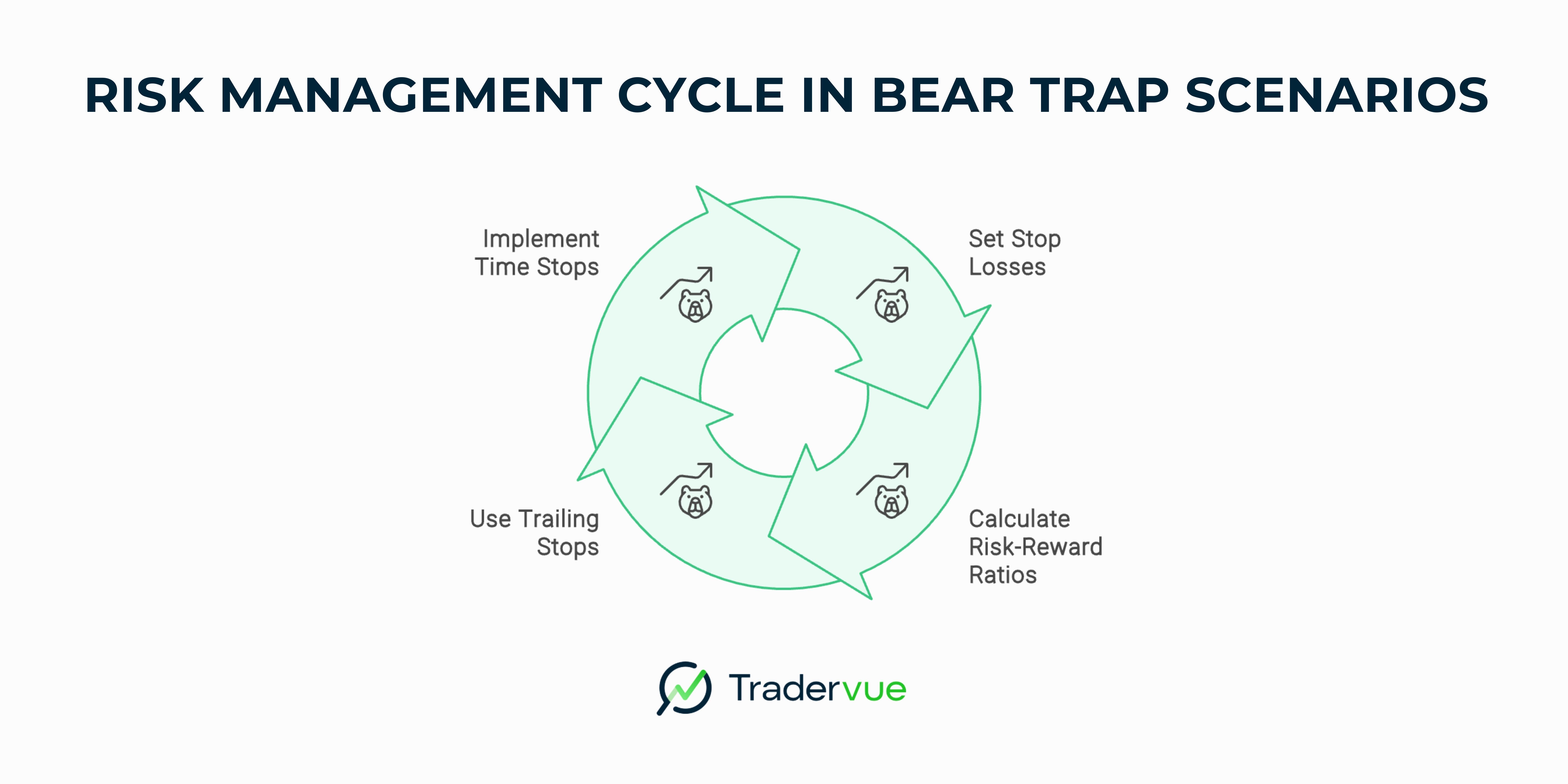

Risk Management in Bear Trap Scenarios

Effective risk management is crucial:

Set appropriate stop losses

Calculate risk-reward ratios

Use trailing stops

Implement time stops

Remember, while potential gains can be attractive, it's essential to be aware of the possibility of further losses.

A thorough understanding of market trends and price movements is crucial for successful bear trap trading.

Psychology of Trading Bear Traps

Mastering the mental game is essential:

Control your emotions

Learn to handle false breakouts

Overcome fear of missing out (FOMO)

Develop a disciplined trading plan

Advanced Bear Trap Concepts

For seasoned traders:

Market manipulation and bear traps

Impact of high-frequency trading

Bear traps in different market conditions (bull market vs. bear market)

Seasonal patterns and temporary pauses in strong uptrends

Understanding how institutional investors and large players can influence market movements is crucial for identifying potential bear traps. Traders should also be aware of how bear traps work in both bearish and bullish markets.

Case Studies

Real-world examples provide valuable insights:

Famous bear trap instances

Successful bear trap trades

Lessons from bear trap failures

A bear trap example might involve a stock experiencing a downward price movement, breaking below a key support level with high volume.

This could trigger stop losses and attract short sellers.

However, if this is followed by a sudden reversal and price increases, it could indicate a bear trap.

Such scenarios often involve a lower price followed by a rapid price increase, catching bearish investors off guard.

Tools and Resources

Equip yourself with:

Charting software and platforms

Screeners and scanners for detecting high RSI and other indicators

Educational resources

Trading communities and forums

These tools can help you identify price trends, analyze candlestick patterns, and spot potential bear traps across various financial markets.

Pay attention to volume indicators and trend lines, as they can provide valuable insights into potential bear traps.

Regulatory Considerations

Stay informed about:

Market manipulation laws

Short selling regulations

Reporting requirements for large positions

These regulations can affect how bear traps form and play out in the market. Understanding these rules is crucial for making informed trading decisions.

Future of Bear Trap Trading

The market is evolving with:

AI and machine learning impacts

Changing market dynamics, especially in the crypto market

Potential regulatory shifts affecting institutional investors and retail investors alike

As markets become more sophisticated, the nature of bear traps and how traders identify them may change. Staying updated on these developments is a good idea for any serious trader.

Conclusion

Understanding bear traps is crucial for successful trading in financial markets.

By recognizing their patterns, employing effective strategies, and managing risks, you can navigate these market pitfalls.

Remember, while average gains from successfully trading bear traps can be significant, they come with high risk.

Always conduct thorough research, stay updated on market trends, and consider seeking investment advice before making trading decisions.

With practice and continuous learning, you can improve your ability to spot bear traps and potentially turn them into profitable opportunities.

Author:

Patricia Buczko

Category:

User Stories