Fair Value Gaps Explained

Fair value gaps (FVGs) are key to the smart money concept of FVG trading.

They show up when market sentiment shifts dramatically, causing rapid price movements on price charts.

Price action traders use these gaps to gain valuable insights into market dynamics.

The Anatomy of a Fair Value Gap

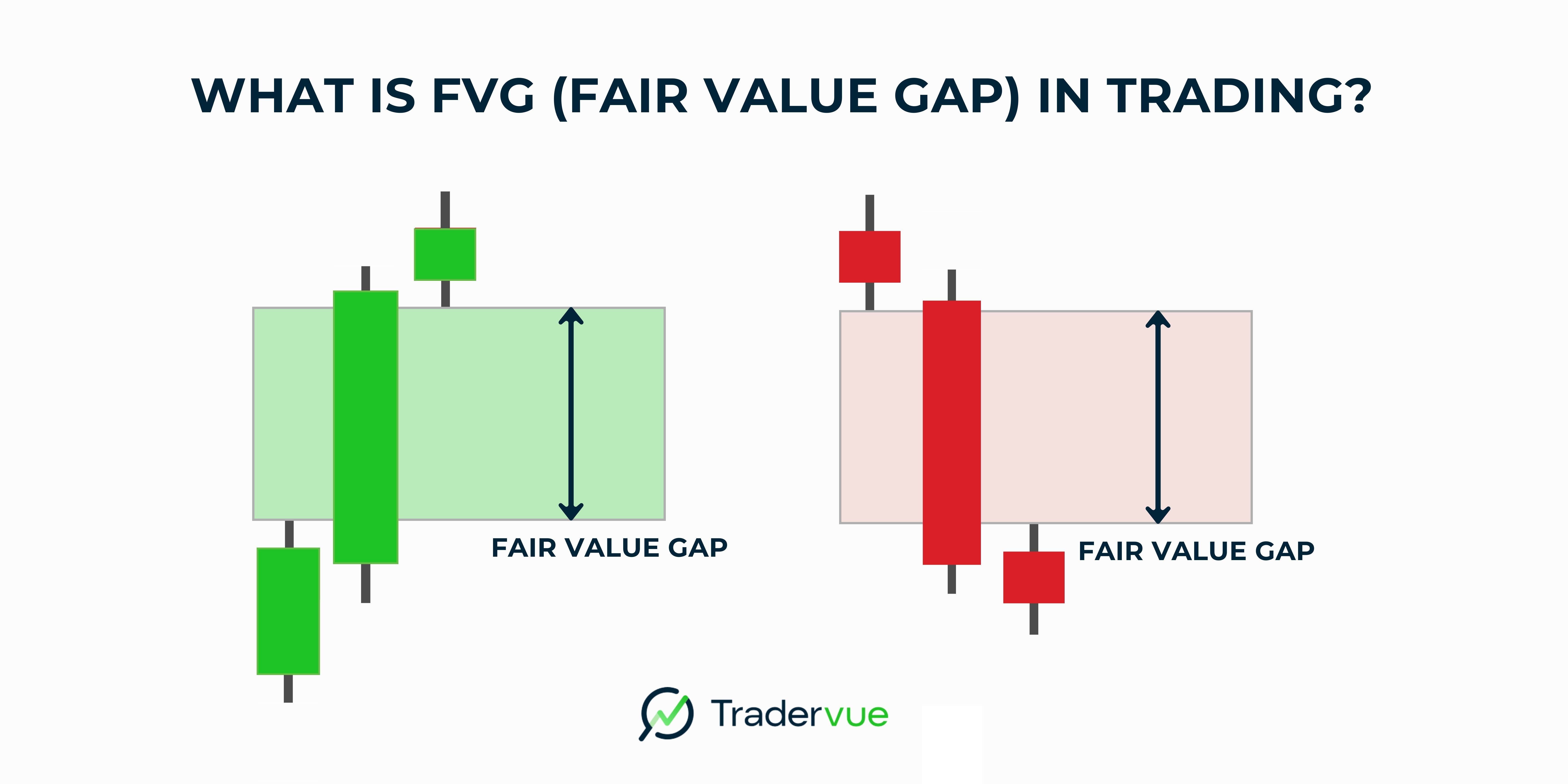

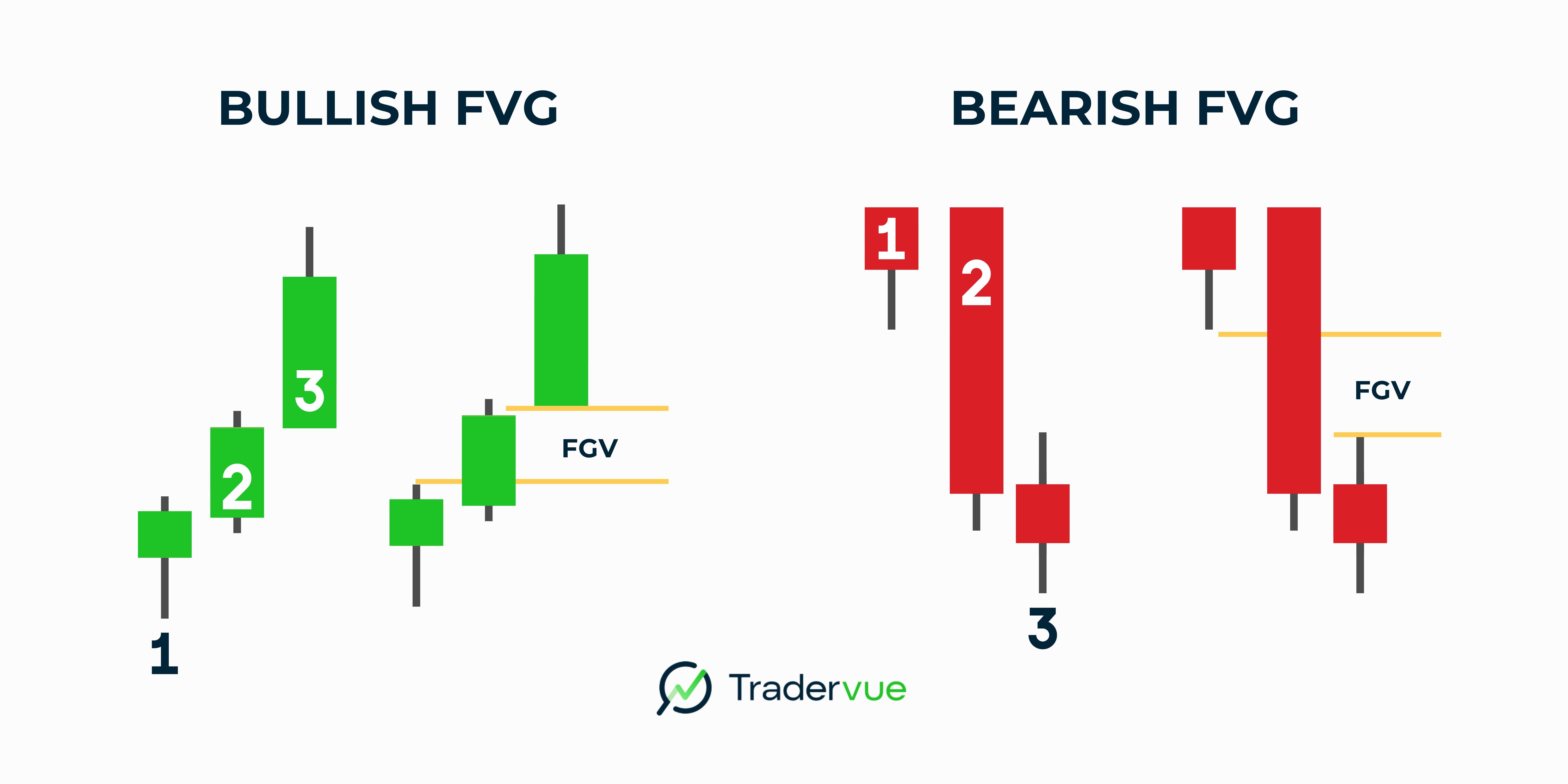

A fair value gap is typically identified by a three-candle pattern:

The first candle in the current trend direction

A strongly opposing large candle that closes beyond the open of the first candle

Third candles that continue in the direction of the second candle

Bullish FVGs appear when price moves up rapidly, while bearish fair value gaps occur during sharp price movements downward.

Visually, FVGs appear as empty spaces on candlestick charts where no trading activity has taken place, similar to traditional price gaps but forming during active trading hours.

The Psychology Behind Fair Value Gaps

FVGs represent significant market inefficiencies and supply and demand imbalances.

They often occur when large institutional trades enter or exit positions, causing rapid price movements that retail market participants cannot immediately react to.

This shift in market sentiment can lead to continued momentum in the direction of the gap, as traders adjust their positions to the new perceived intrinsic value.

Fair Value Gaps vs. Liquidity Voids

Liquidity voids are areas on a chart where there is a lack of trading activity or orders.

They can appear as large candles or spaces between price levels where the market moved quickly due to a lack of opposing orders.

While both FVGs and liquidity voids represent areas of rapid price movement, they differ in scale and formation.

FVGs are typically smaller and more frequent, often occurring on lower time frames.

Liquidity voids, on the other hand, tend to be larger and more significant, often visible on higher timeframes.

An FVG can evolve into a liquidity void if it remains unfilled for an extended period, especially when observed on higher time frames.

This transformation can have important implications for traders using multiple timeframe analysis.

Identifying Fair Value Gaps

Manual Chart Analysis

To manually identify FVGs:

Look for a series of three candles with a strong move in one direction

Check if the third candle's open does not overlap with the first candle's close

Confirm that the space between these levels has not been filled by subsequent price action

Be cautious of false signals, particularly in choppy market conditions where small gaps may not be significant.

Using Indicators and Tools

Many trading platforms offer FVG indicators that automatically detect and highlight these gaps on trading charts.

While these tools can save time, it's important to understand their inherent limitations and not rely on them exclusively.

Fair Value Gap Scanners

Custom scanners can be built to identify FVGs across multiple assets or timeframes. Key parameters for effective FVG scanning include:

Minimum gap size

Timeframe

Asset class

Volume thresholds

Trading Strategies Using Fair Value Gaps

The "Gap Fill" Strategy

The gap fill strategy is based on the principle that price often returns to "fill" the FVG. Traders can:

Enter trades when price approaches a previously identified FVG

Set profit targets at the opposite end of the gap

Place stop-loss orders beyond the gap's furthest point

Risk management is crucial, as not all gaps will fill completely or immediately.

Trend Continuation Trades

FVGs can be used to confirm market trends:

Identify the overall trend direction (bullish trend or bearish trend)

Look for FVGs that form in the direction of the trend

Enter trades when price retraces to the FVG level

Combining FVGs with other technical analysis tools, such as trend lines or moving averages, can increase the strategy's robustness.

Reversal Trading with FVGs

FVGs can also signal potential market structure shifts:

Identify an FVG against the current trend direction

Wait for price to return to the FVG level

Look for confirmation signals before entering a trade

Timing entries is critical in reversal trading to avoid premature positions against a strong trend.

Combining FVGs with Other Smart Money Concepts

FVGs often interact with other price action concepts:

Order blocks: Areas of strong buying or selling pressure that can coincide with FVGs

Breaks of structure: FVGs can form during significant market structure shifts

Change of character: FVGs may signal a change when they form against the prevailing trend

Liquidity grabs: Institutional investors may use FVGs to trap retail traders before major moves

Advanced Fair Value Gap Concepts

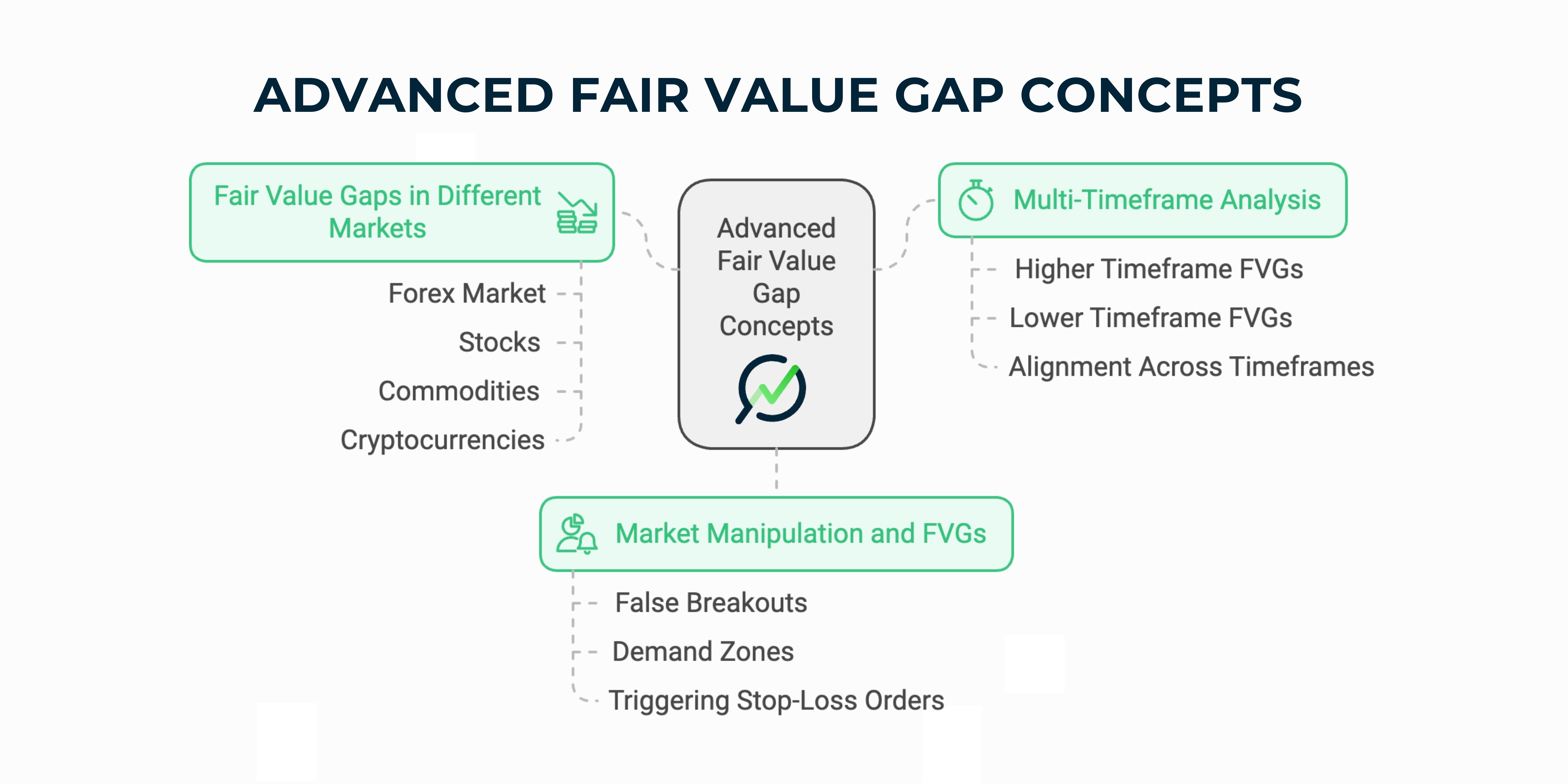

Multi-Timeframe Analysis

Higher timeframe context is crucial when trading FVGs:

Identify FVGs on higher timeframes for overall market direction

Use lower timeframe FVGs for precise entry and exit points

Ensure alignment between FVGs across different timeframes for stronger signals

Fair Value Gaps in Different Markets

FVGs occur in various financial markets, but their behavior may differ:

Forex market: FVGs are common due to 24-hour trading and high liquidity

Stocks: FVGs often form around earnings reports or significant new information

Commodities: FVGs may be influenced by supply and demand shocks

Cryptocurrencies: High market volatility can create numerous FVGs, requiring careful filtering

Market Manipulation and FVGs

Institutional investors may use FVGs to trap retail traders:

Creating false breakouts by pushing price to fill an FVG

Using FVGs as demand zones for large orders

Initiating strong moves after filling an FVG to trigger stop-loss orders

Recognizing these patterns can help traders avoid common traps set by the "inner circle" of traders.

Risk Management and Fair Value Gap Trading

Optimal stop loss placement for FVG trades:

Beyond the opposite side of the FVG

At the nearest significant resistance levels or support levels

Using a fixed risk percentage based on account size

Consider using adjacent structure levels to refine stop loss decisions.

Calculate appropriate position sizes based on:

The distance between entry and stop loss

Account risk tolerance (typically 1-2% per trade)

Gap magnitude (larger gaps may warrant smaller positions due to increased market volatility)

Backtesting and Optimizing FVG Strategies

Key components of an FVG-based system:

Gap identification criteria (size, timeframe, market conditions)

Entry and exit points

Risk management parameters

Filters for market conditions and related products

Tools for backtesting FVG strategies:

Trading platform built-in backtesting features

Specialized backtesting software

Custom coding for more flexibility

Avoid common pitfalls such as overfitting and look-ahead bias when analyzing past performance.

Limitations and Criticisms of Fair Value Gap Trading

FVGs may not always be filled due to:

Changing market conditions

Strong trend continuation

Fundamental shifts in intrinsic value

Market volatility or low liquidity can affect FVG reliability.

Basing trades solely on FVGs can be risky:

Ignoring other important technical and fundamental factors

Missing broader market context

Increased vulnerability to false signals

A comprehensive approach incorporating multiple analysis methods is generally more robust.

Integrating Fair Value Gaps into Your Trading Plan

Steps to incorporate FVGs:

Define specific FVG criteria for your strategy

Establish rules for entries, exits, and risk management

Create a checklist for FVG trade qualification

Determine position sizing based on FVG characteristics

Set guidelines for combining FVGs with other analysis methods

Key metrics to track:

Win rate for FVG trades

Average risk-reward ratio

Performance in different market conditions

Effectiveness of various types of fair value gaps (bullish vs. bearish, different timeframes)

Use this data to continuously refine your FVG approach.

Conclusion

Fair value gaps are powerful tools for identifying potential trading opportunities and understanding market structure.

When used in conjunction with other technical analysis methods and proper risk management, FVGs can enhance a trader's ability to read price action and make informed trading decisions.

However, it's crucial to remember that trading involves a high level of risk, and past performance does not guarantee future results.

The concept of fair value gaps should be used as part of a broader trading strategy and not relied upon exclusively.

Always conduct thorough research and consider seeking financial advice before making any investment decisions.

This article is for educational purposes only and should not be considered investment advice. Different traders may interpret and use FVGs differently, and what works for one may not work for another.

Remember that successful FVG trading requires practice, patience, and continuous learning.

As with any trading strategy, it's essential to thoroughly test and validate FVG concepts before applying them to live trading with real money.

Author:

Patricia Buczko

Category:

User Stories