SSR Stock Rule: Master Short Sale Restrictions

The Short Sale Rule (SSR), also known as the short-sale rule or SSR rule, is a vital stock market regulation that impacts trading strategies and market dynamics.

Implemented by the U.S. Securities and Exchange Commission, it restricts certain short-selling activities when a stock's price drops sharply, aiming to prevent short sellers from exerting excessive downward pressure on a declining market.

Understanding SSR is crucial for making informed investment decisions in U.S. securities markets.

Understanding Short Selling

Short selling is a trading strategy where investors take a short position on a stock.

Traders borrow shares, sell them at the current market price, and hope to buy them back at a lower price later.

The profit is the difference between the selling price and the lower repurchase price, minus borrowing costs.

This practice allows traders to profit from declining share prices and can provide liquidity to financial markets.

However, it carries significant risks, including potential settlement risks. If the stock price rises instead of falls, losses can increase rapidly.

Short positions provide valuable insights into a company's financial health and play a significant role in price discovery.

The Short Sale Rule (SSR) Explained

The short sale restriction rule activates when a stock's price falls 10% or more from the previous day's close.

This notification threshold limits short selling to prevent further price drops.

The rule typically lasts for the rest of the trading day and the end of the following trading day.

Key components of the rule include:

The 10% price decline trigger

The duration of the restriction

The requirement that short sales be executed only at a higher price or above the current best bid

SSR is designed to promote market stability and investor confidence during periods of significant decline.

It aims to prevent short selling of the stock that is already experiencing downward pressure.

History and Evolution of the SSR

SSR originated after the Great Depression and has evolved with the markets.

The original Uptick Rule was implemented in 1938 in response to the market crash of 1929.

It required that every short-sale order be entered at a price higher than the previous trade price.

In 2007, the SEC removed the Uptick Rule, citing studies suggesting it was no longer effective in modern markets.

However, the 2008 financial crisis reignited concerns about unconstrained short-selling activities.

In 2010, the SEC introduced the Alternative Uptick Rule, which is the basis for the current SSR. This new rule aims to curb potentially abusive short selling during sharp declines in market prices.

How SSR is Triggered

A 10% price drop from the previous day's close triggers SSR.

This calculation is based on the stock's price at the exchange where it's listed.

Once activated, SSR remains in effect for the rest of the trading day and the entire following trading day.

For example, if a stock closes at $100 on Monday and drops to $90 or below at any point on Tuesday, SSR would be triggered and remain in effect until the end of trading on Wednesday. This mechanism aims to reduce market volatility and protect against excessive short selling of a particular stock during sharp declines.

Mechanics of SSR

When SSR is active, short sales can only be executed at a price above the current best bid.

This restriction aims to prevent short sellers from exerting additional downward pressure on the stock price.

However, certain types of short sales are still permitted under SSR, such as those by market makers fulfilling their obligations to maintain inventory levels and provide liquidity.

The rule also impacts bid prices, often leading to wider spreads in affected stocks.

Market makers get some exceptions to maintain inventory levels and provide liquidity.

The rule doesn't affect long positions or regular market orders. SSR operates independently of, but in conjunction with, other market mechanisms like circuit breakers, which halt trading entirely in exceptional situations.

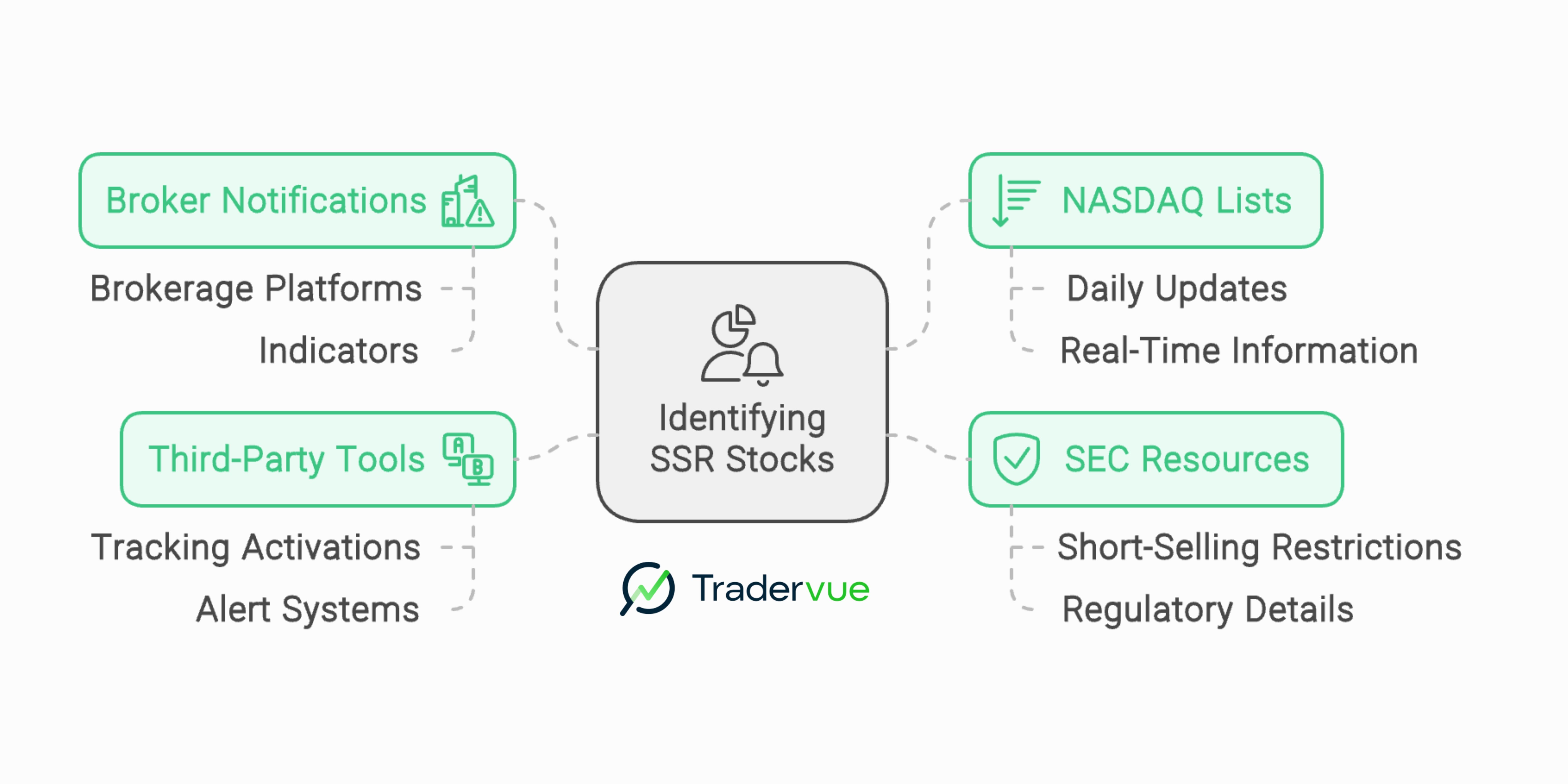

Identifying Stocks Under SSR

Traders can identify SSR stocks through various means:

Broker notifications and indicators on brokerage platforms

NASDAQ's daily list of stocks in SSR mode, updated throughout the trading day

SEC resources providing information on short-selling restrictions

Third-party tools that track and alert traders to SSR activations

Being aware of which stocks are under SSR is crucial for implementing appropriate trading strategies.

This information helps traders make informed trading decisions and adjust their approaches accordingly.

Trading Strategies for SSR Stocks

SSR affects various market participants differently.

Long-term investors might look for potential short squeezes, as SSR can make it more difficult for short sellers to maintain their positions.

They may seek opportunities to enter long positions when buying pressure increases.

Short sellers need to adapt their strategies when SSR is in effect.

They may use limit orders to ensure their short sales are executed in compliance with the rule. Some might turn to options trading as an alternative, using stock options like put options to profit from potential price declines.

Day traders must adjust their trading strategies, considering the impact of SSR on intraday price movements.

They might focus on stocks nearing the SSR trigger point or those already under restriction, looking for potential reversals or continuation patterns.

Swing traders need to factor in the duration of SSR when planning their entries and exits.

They might see SSR as a signal to watch for potential trend changes or as an opportunity to enter positions in anticipation of a rebound.

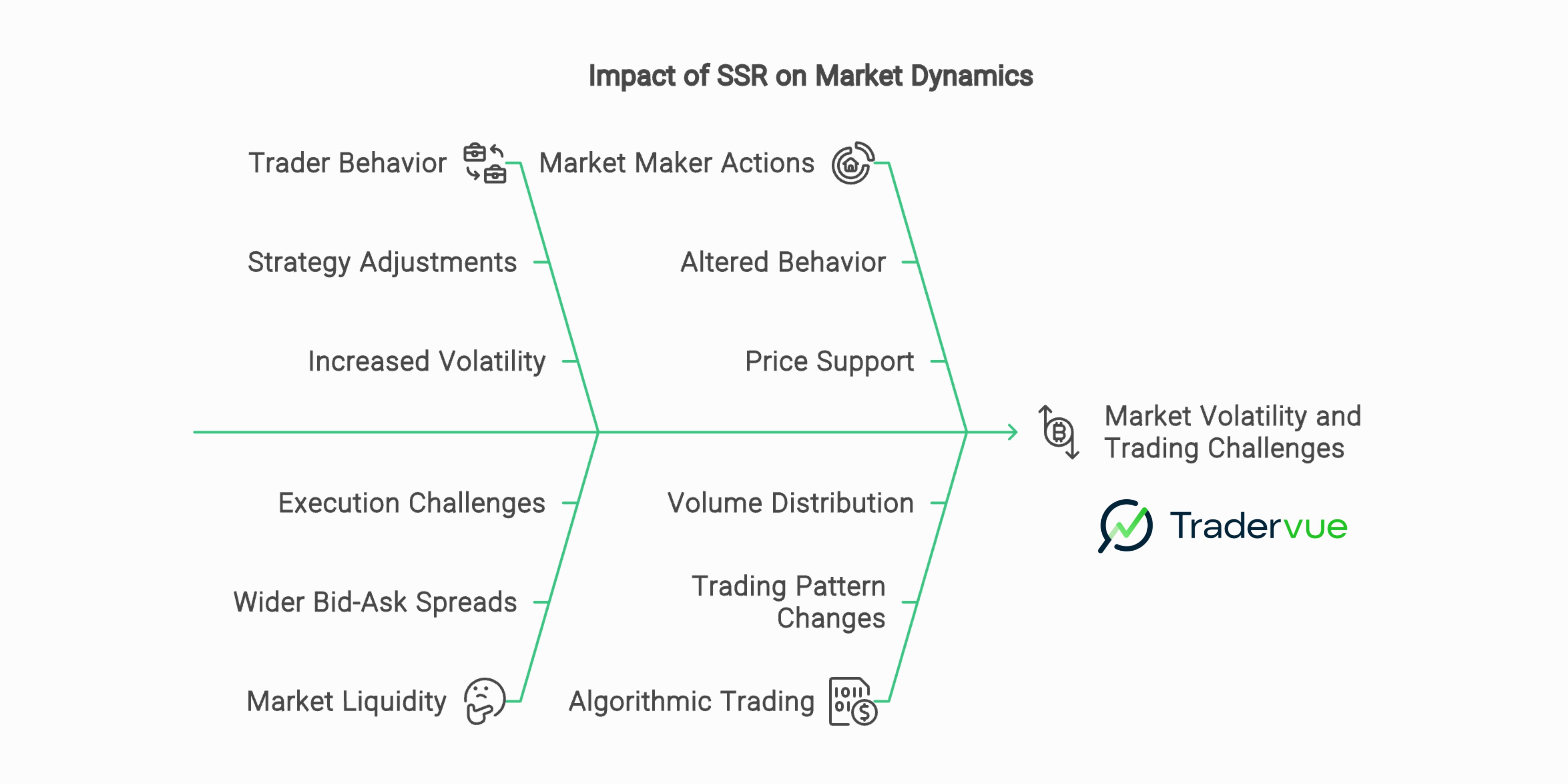

Impact of SSR on Market Dynamics

SSR can significantly affect stock price movements, often leading to increased market volatility as traders adjust their strategies.

It can impact liquidity, sometimes resulting in wider bid-ask spreads.

This can make it more challenging to execute trades at desired prices.

Market makers may alter their behavior under SSR, potentially affecting price discovery and order execution.

The restriction on short selling can sometimes lead to artificial price support, as downward pressure is limited.

SSR can also influence the behavior of algorithmic trading systems, which need to be programmed to comply with the rule.

This can lead to changes in trading patterns and volume distribution throughout the day.

Global Perspectives on Short Selling Restrictions

While this article focuses on SSR in the United States, it's worth noting that other countries have their own approaches to regulating short selling.

For example, the European Union has implemented the EU Short Selling Regulation (EU SSR), which applies to member states.

This regulation covers various aspects, including restrictions on naked short selling and reporting requirements for significant net short positions.

The UK law also has its own set of rules governing short selling, which were adapted from EU regulations after Brexit.

Other countries may have different approaches, reflecting their specific market conditions and regulatory philosophies.

Conclusion

SSR plays a significant role in stock trading, affecting prices, trading strategies, and overall market dynamics.

It represents a balance between allowing short selling as a legitimate trading strategy and preventing potential market abuses.

Staying informed about SSR helps traders navigate financial markets more effectively, whether they're taking long or short positions.

As with all aspects of trading, it's crucial to remember that past performance doesn't guarantee future results.

Always consider current market conditions, conduct thorough research, and understand the potential risks before making investment decisions.

While this article provides valuable insights, it should not be considered financial or legal advice.

For specific questions about SSR or other regulatory matters, consult with appropriate regulatory bodies or financial professionals.

SSR is just one of many factors to consider in the complex world of stock trading, but understanding its mechanics and implications can give traders a valuable edge in their market activities.

As financial markets continue to evolve, staying informed about regulations like SSR remains an essential part of successful trading strategies.

Author:

Patricia Buczko

Category:

User Stories